Join us and hundreds of changemakers to celebrate successes, share learning, and forge new...

Join us and hundreds of changemakers to celebrate successes, share learning, and forge new...

At the end of February we launched our CLT Network Manifesto. As the General Election draws closer...

Announcing the CLT Network’s research partnership with Shared Assets to explore the role and opportunities for English and Welsh CLTs stewarding land for nature, farming and communities.

The CLT Network has published their 2024 Community Land Trusts Manifesto with policies that would...

Our CEO, Tom Chance, shares the CLT Network's new manifesto, calling on our next government to...

Join us at this special session to explore the findings from the 2023 Community Led Housing Growth...

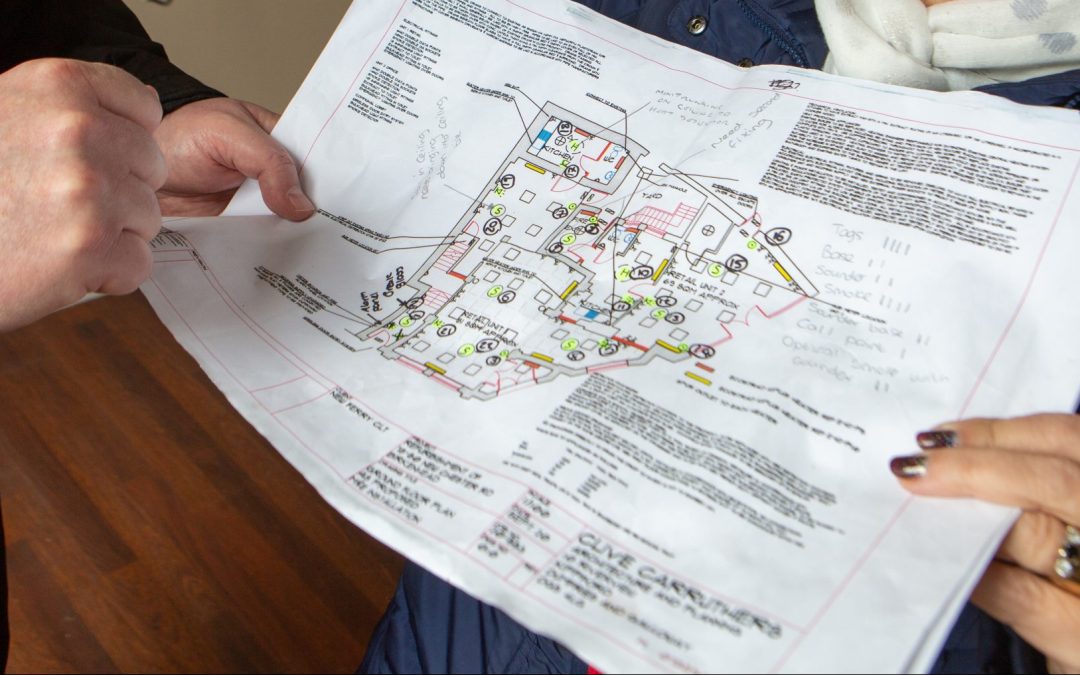

Whether you’re building local trust, sustaining credibility, or making sure that your development...

Understanding the operations and governance of running a CLT can be complex - especially finding...

At the end of December we heard some great policy news in the newly revised NPPF. In this session...

Our chief executive, Tom, shares an update on the planning policy and leasehold reform in England...

CLTs can run on a shoestring, but there will be some essential costs to run a robust and effective...

Our chief executive, Tom, reflects in this essay on why we should rethink the role of the...

Our chief executive, Tom, spent a few days in Cornwall, speaking at a conference and meeting some...

Have you seen Oxfordshire CLT, Calder Valley CLT and Stokes Croft CLT raise...

With the ongoing cost-of-living crisis more people than ever are in need of genuinely affordable...

There is a lot of support out there for CLTs in their early stages, but we know that there is life...

As well as AGM business, the CLT Network AGM includes the fifth annual CLT Awards, networking...

We know that community led housing policies aren’t always supportive enough in Wales. That’s why...

Our chief executive, Tom Chance, writes with Owen Jarvis from the UK Cohousing Network about our...

Join us for a forum to review and priorities and ideas for the CLT Network's manifesto and...

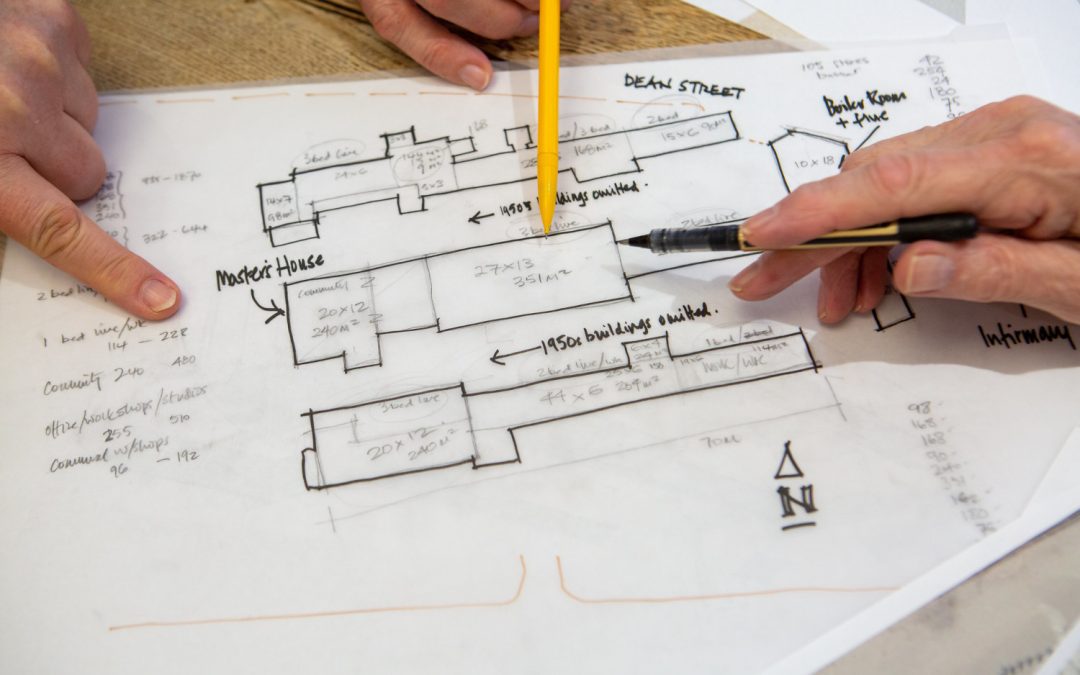

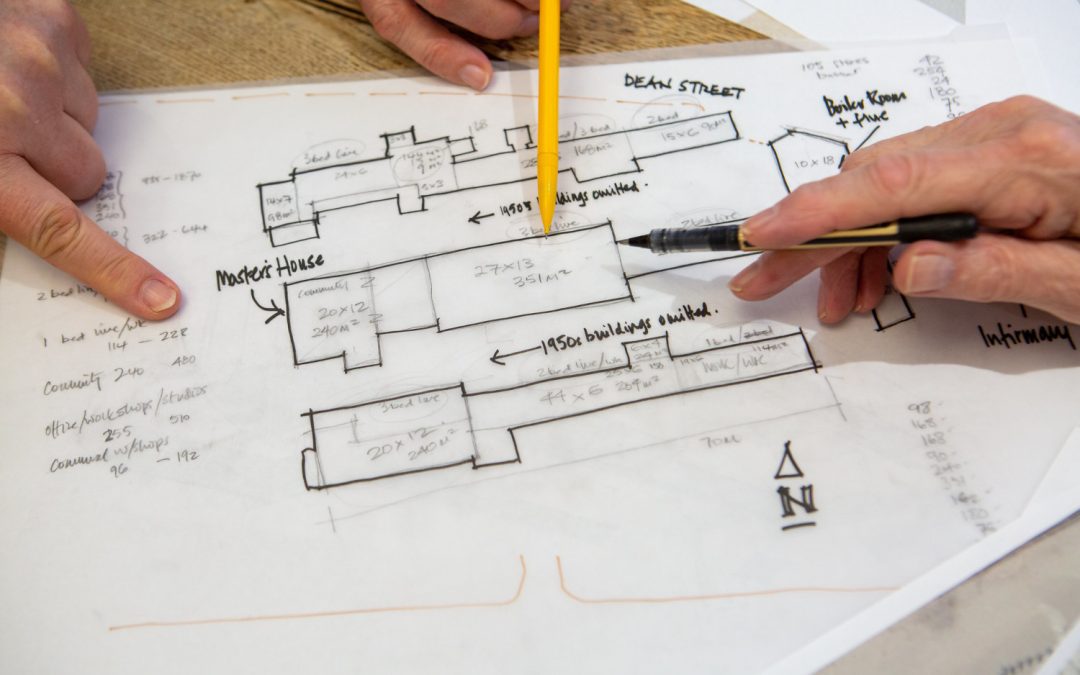

Finishing your first project and thinking 'what now?!'? At the beginning of your CLT journey and...

Campaign for more supportive community led housing policies The Community Land Trust...

Our chief executive, Tom Chance, recently attended the International Social Housing Festival in...

We know how important a supportive council can be for the success of your Community Land Trust’s...

From creating relationships with local authorities and stakeholders to getting your projects...

CLTN partnering in Enabling Water Smart Communities Programme Enabling Water Smart Communities...

Our CEO writes about a recent study tour around the USA, and his reflections on what we can learn in the UK about collective leadership and building community capacity for regeneration,

Building a more inclusive CLT movement Last year, we commissioned The Institute of Community...

Managing a strong and professional tenant-landlord relationship is key to the success of CLTs with...

What could be a better example than a neighbourhood taking control, then being in charge of its...

Our chief executive, Tom Chance, reviews recent academic research into Power to Change's Homes in...

Hear from our CEO Tom Chance about updates on our policy work advocating for CLTs. You can expect...

We have responded to Government’s NPPF consultation on changes to the English planning system. We...

We welcome our members to our third installment on CLTs allocations. Attendees will hear from John...

We are publishing our draft response to the Government's NPPF consultation, and calling on our...

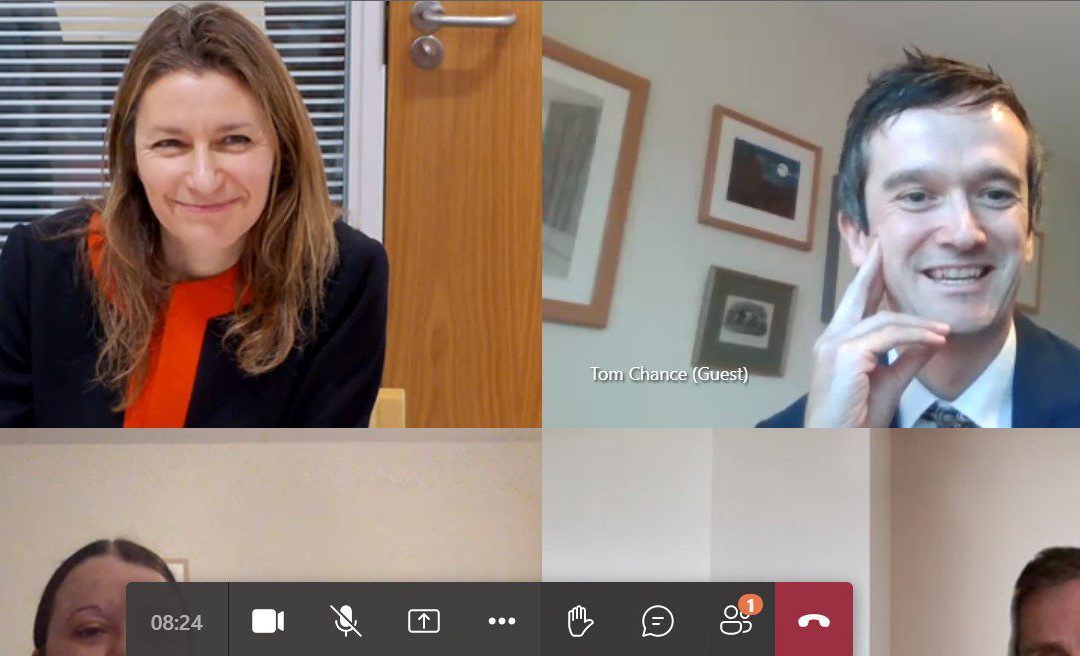

The Rt Hon Lucy Frazer MP, Minister of State for Housing, met online earlier today (19 December...

Join us for this member webinar, where you’ll hear from speakers on the past, present, and future of the CLT movement around the world.

This guest blog post was authored by Anne-Helene Sinha and Nayantara Nath of the Venturesome team...

Our chief executive, Tom Chance, responds to a new report on community asset ownership by a Welsh...

Our chief executive, Tom Chance, summarises our various lobbying activities and where the community land trust movement stands amid this shifting political climate.

Our chief executive, Tom Chance, summarises our various lobbying activities and where the community land trust movement stands amid this shifting political climate.

We have urged the government to fully exempt CLTs from leasehold enfranchisement in future legislation.

The Community Housing Fund is still on the table. Here’s a quick explanation of the current position, how we got here, and what we can all do to get the fund reopened.

The Chair of our board of trustees, Steve Hoey, reflects on his visit to Brussels for a meeting exploring the future of a Europe-wide community land trust network.

Our chief executive, Tom Chance, writes about Local Trust's recent conference on the evidence base...

New research carried out by the Community Land Trust Network reveals the strong levels of local...

Chief Executive Tom Chance writes about some new research looking at what CLTs are, and what they...

The Community Housing Fund Revenue Programme 2021/22 has awarded 52 grants to community organisations across England who are planning to deliver over 1,200 additional affordable homes. More than half of the bids were from community land trusts (CLTs), which remain the largest driver of growth in the community led housing sector.

The Community Land Trust Network has brought together a group of nine CLT ambassadors from CLT...

This guest blog was authored by Hannah Emery-Wright, Communities Manager with London CLT, and Claudia Firth, freelance Community Management Consultant and resident of a London co-op. It covers what a Resident Management Company (RMC) is, how London CLT set one up and the lessons learnt along the way.